Introduction

Financial statements are often viewed as technical documents reserved for accountants, auditors, or financial analysts. In reality, they are among the most powerful tools available to anyone seeking to make informed business or investment decisions. Financial statements tell the story of a company—how it earns money, how it spends it, how it manages risk, and how sustainably it operates.

As a CEO responsible for strategic decision-making, capital allocation, and long-term value creation, I rely on financial statements not as historical records, but as strategic instruments. When interpreted correctly, they provide insights that can guide investment decisions, reveal hidden risks, and uncover opportunities for profit.

This article offers a comprehensive, executive-level guide on how to interpret and profit from financial statements, moving beyond basic definitions to practical application and strategic insight.

Why Financial Statements Matter to Decision-Makers

Financial statements are the language of business. They provide a standardized framework for evaluating performance, comparing companies, and assessing financial health.

From a CEO perspective, financial statements serve three critical purposes:

- Measuring operational effectiveness

- Supporting strategic planning

- Guiding investment and capital allocation decisions

Ignoring or misinterpreting them increases the risk of poor decisions and financial loss.

The Three Core Financial Statements

At the heart of financial analysis are three primary statements:

- The Income Statement

- The Balance Sheet

- The Cash Flow Statement

Each provides a different lens through which to view a company’s financial reality. True insight emerges only when they are analyzed together.

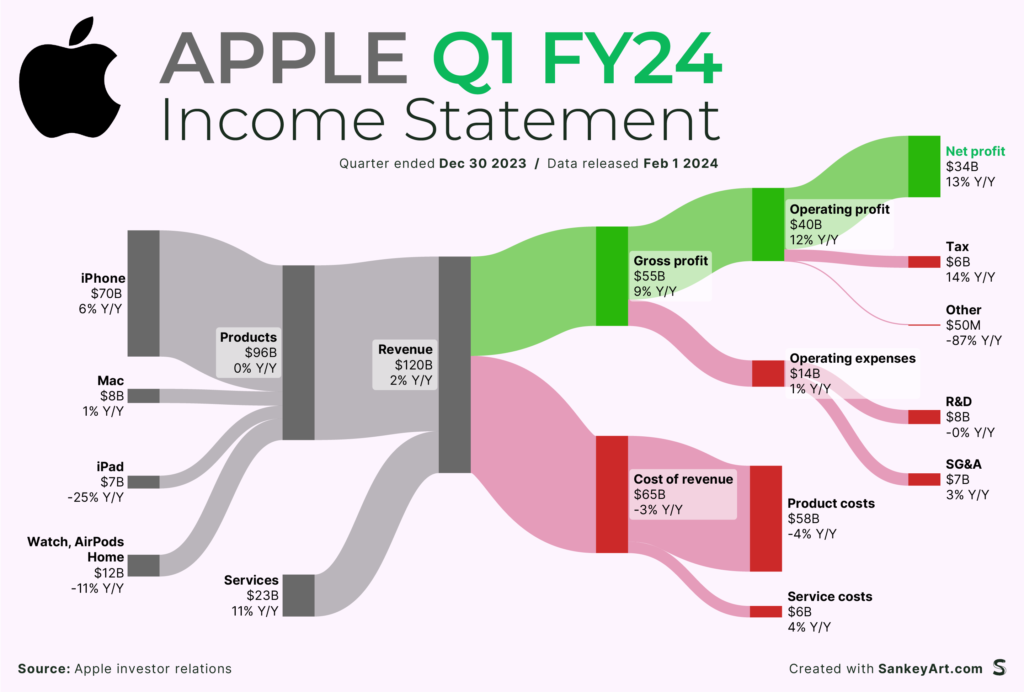

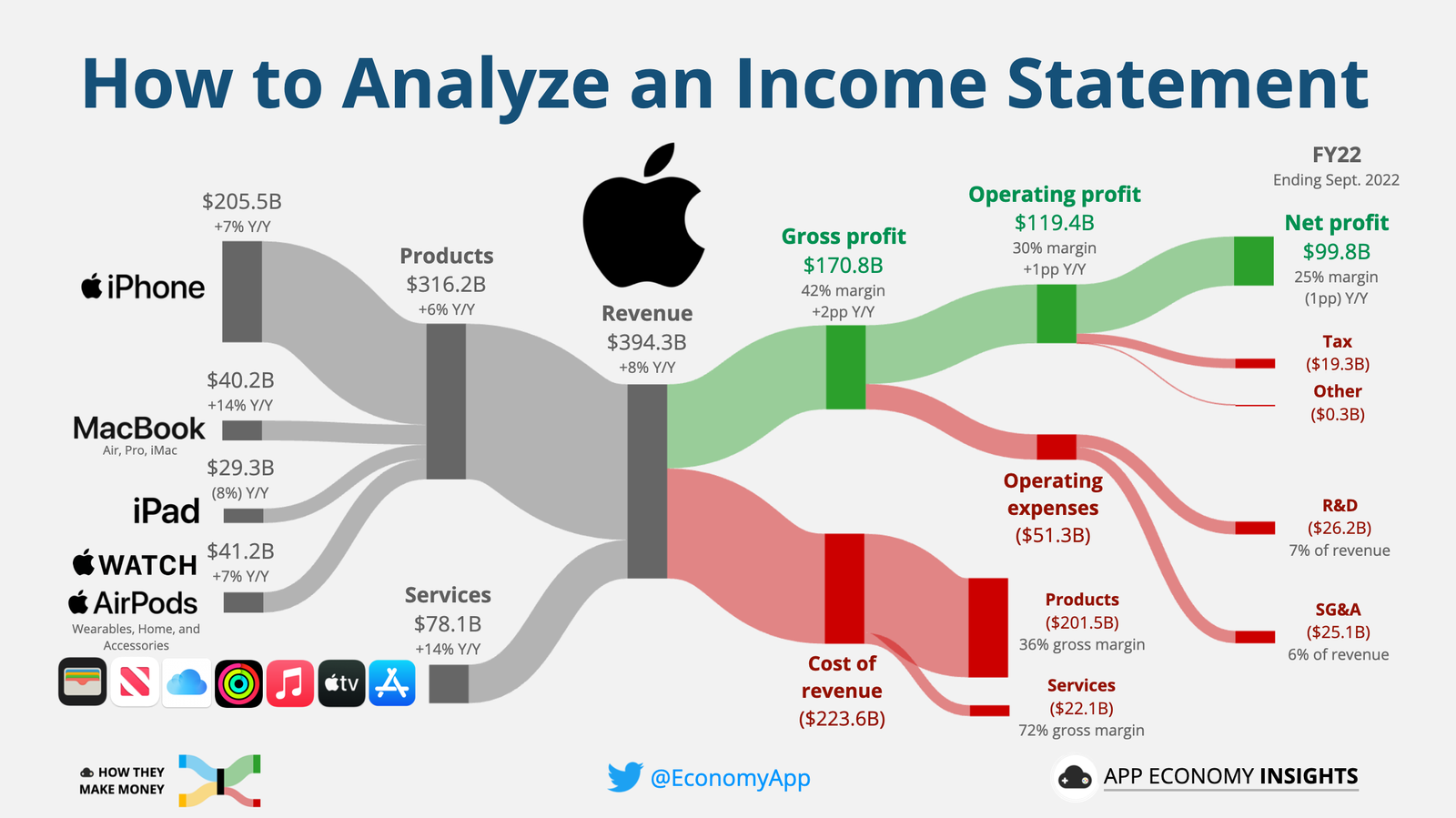

The Income Statement: Understanding Profitability

The income statement shows how a company generates revenue and incurs expenses over a specific period.

Key components include:

- Revenue

- Cost of goods sold

- Operating expenses

- Operating income

- Net income

From an executive standpoint, the income statement reveals not just profitability, but the quality and sustainability of earnings.

Interpreting Revenue Trends

Revenue growth is often celebrated, but not all growth is equal.

A CEO evaluates:

- Consistency of revenue growth

- Sources of revenue

- Pricing power

- Customer concentration

Unsustainable or low-quality revenue growth can mask deeper problems.

Expense Structure and Operating Efficiency

Expenses reveal how effectively a company converts revenue into profit.

Analyzing:

- Fixed versus variable costs

- Operating margins

- Cost discipline over time

helps identify whether management is creating leverage or inefficiency.

Profit Margins as Strategic Indicators

Gross, operating, and net margins provide insight into competitive advantage.

Stable or improving margins often indicate strong positioning, while declining margins signal rising competition or operational challenges.

The Balance Sheet: Assessing Financial Strength

The balance sheet provides a snapshot of a company’s financial position at a specific moment.

It is built on a simple equation:

Assets = Liabilities + Equity

From a CEO perspective, the balance sheet reveals resilience, flexibility, and risk exposure.

Evaluating Asset Quality

Not all assets contribute equally to value creation.

Executives examine:

- Liquidity of assets

- Asset turnover

- Impairment risks

Poor-quality assets weaken long-term profitability.

Understanding Liabilities and Debt Structure

Debt can accelerate growth or destroy value, depending on how it is managed.

Key considerations include:

- Debt maturity schedules

- Interest coverage

- Leverage ratios

Disciplined debt management is a hallmark of strong leadership.

Equity and Shareholder Value

Equity reflects accumulated earnings, capital contributions, and retained profits.

From an executive viewpoint, equity trends indicate whether value is being created or diluted over time.

The Cash Flow Statement: Following the Money

Cash flow is often more important than reported profit.

The cash flow statement shows how cash moves through the business via:

- Operating activities

- Investing activities

- Financing activities

CEOs prioritize cash flow as the lifeblood of sustainability.

Operating Cash Flow and Earnings Quality

Strong operating cash flow confirms that reported earnings are real and repeatable.

A gap between profit and cash flow is a warning sign that demands investigation.

Investing Cash Flow and Growth Strategy

Investing cash flow reveals how a company reinvests in its future.

Executives assess:

- Capital expenditures

- Acquisitions

- Asset disposals

Smart reinvestment drives long-term value creation.

Financing Cash Flow and Capital Decisions

Financing activities show how a company funds its operations.

Share buybacks, dividends, and debt issuance reflect management’s capital allocation priorities.

Connecting the Statements for Deeper Insight

Financial statements should never be analyzed in isolation.

Linking profitability, balance sheet strength, and cash flow reveals:

- Financial sustainability

- Risk exposure

- Value creation efficiency

This integrated view is essential for profit-driven decisions.

Financial Ratios as Strategic Tools

Ratios transform raw numbers into meaningful comparisons.

Key categories include:

- Profitability ratios

- Liquidity ratios

- Leverage ratios

- Efficiency ratios

CEOs use ratios to track trends rather than chase single data points.

Red Flags Hidden in Financial Statements

Certain patterns warrant caution:

- Rising revenue with declining cash flow

- Increasing leverage without earnings growth

- Frequent accounting adjustments

Recognizing red flags protects capital.

Using Financial Statements for Investment Decisions

Investors who understand financial statements gain a competitive advantage.

From a CEO perspective, profitable investing focuses on:

- Financial resilience

- Consistent cash generation

- Prudent management behavior

From Analysis to Action: Turning Insight into Profit

Interpreting financial statements is only valuable if it leads to better decisions.

Profiting from analysis involves:

- Avoiding overvalued or fragile companies

- Identifying undervalued strength

- Allocating capital efficiently

Behavioral Discipline in Financial Analysis

Numbers do not eliminate bias. Emotional attachment and confirmation bias distort interpretation.

Executive discipline requires objectivity and skepticism.

Long-Term Perspective and Compounding Value

Financial statements reveal trends that unfold over years, not quarters.

Long-term investors benefit from patience and consistency.

The CEO Framework for Financial Statement Mastery

From leadership experience, mastery follows this framework:

- Understand each statement individually

- Analyze trends, not snapshots

- Connect profitability, balance sheet, and cash flow

- Identify risks and red flags

- Act with discipline

Financial Literacy as a Competitive Advantage

Those who can interpret financial statements clearly gain an edge in business and investing.

Financial literacy empowers independent thinking and better outcomes.

Conclusion: Read the Story Behind the Numbers

Financial statements are more than reports—they are narratives of strategy, execution, and discipline.

As a CEO, I view them as essential tools for protecting capital and creating profit. When interpreted thoughtfully, financial statements reveal truths that marketing, headlines, and opinions often obscure.

By learning how to read, interpret, and act on financial statements, individuals can make smarter decisions, avoid costly mistakes, and position themselves to profit from informed judgment rather than speculation.

Word Count:

1331

Summary:

Peter Leeds, one of North America’s leading Investment Coaches, is a self-made millionaire who has created his fortunes on the stock markets. He has also empowered thousands of individuals to do the same. He offers sites like http://www.pennystockinsider.com to help penny stock investors make wise decisions.

Keywords:

penny stock investing smallcap microcap

Article Body:

Financial statements are a useful tool for judging the health of a company, and for comparing it to its competitors. They show what the company owes and owns, the profits or loses it has made over a given period, and how their position has changed since their last statement. Generally if you can tell which direction a company is heading in, you can also forecast future stock prices with some accuracy.

Gaining a basic knowledge of financial statements, and applying this knowledge when choosing or assessing investments can help you pick tomorrow’s winning stocks, while avoiding tomorrow’s losers.

Of course, financial statement analysis will not always factor in significant news events, unexpected incidents, changes in management, and other factors which may influence share prices, but it provides a starting point from which to gauge the present value of shares, independent of future occurrences.

The following report details some simple financial statement explanation and analysis methods. Although the topic can get much deeper and more complex, this article is designed to give investors the ability to understand the numbers and simpler of financial ratios, and be able to use that knowledge to assist them to make better decisions when doing their due diligence.

Balance Sheet

The balance sheet shows a company’s financial position at a specific date, usually the last day of the company’s fiscal year for annual reports. One side of the balance sheet shows what the company owns and has owing to it, called assets. The other side represents liabilities, which are what the company owes, and also has shareholders’ equity, which represents the excess of the company’s assets over its liabilities. Shareholder’s equity is often referred to as book value.

Total assets are equal to the sum of the company’s liabilities plus the shareholders’ equity. In other words, take away liabilities from assets and the remainder is what value is owned by the shareholders.

The Balance Sheet can be used to uncover the value of the company, the debt load, and cash position.

Earnings Statement

Also called the Income Statement or Profit and Loss Statement, it shows how much revenue a company received during the year from the sale of its products and services, and the expenses the company incurred due to wages, taxes, operating costs, etc… The difference between the two is the company’s profit or loss for the year. The amount left over after taxes is the net earnings.

Net earnings are basically saying how much money the company �really’ made over the course of the year. Some companies can have low earnings if they used much of their money for research and development, to acquire other companies, fuel aggressive growth, move into new markets, etc, which is much more favorable than if the company had low earnings because they didn’t generate many revenues, their expenses were too high, etc…

Statements of Changes in Financial Position

This shows how the company’s financial position changed from one year to the next. Also called the cash flow statement, this details how the company generated and spent its cash during the year.

This statement can be used in evaluating the liquidity and solvency of a company, and to assess the ability of that company to generate cash internally, to repay debts, to reinvest in itself, etc…

Sources of Financial Reports

Certainly you can get financials from the companies themselves. Most will gladly fax them to you, or mail you their latest quarterly and annual reports.

However, a faster way to access the information can be by Internet. For example, go to Yahoo.com and choose stock quotes. Enter the ticker symbol for the company you are interested in, and Yahoo will provide its most recent press releases, which will include past quarterly and annual reports with the financial statements. You can also check the previous reports to compare which direction the company is moving in and look for trends (i.e. increasing debt load, unpredictable earnings, decreasing revenues, erratic revenues, etc…).

There are also many other Internet resources which provide similar information, such as wsrn.com, bigcharts.com, (canada-stockwatch.com for Canadian issues), etc…

Comparison Shopping

To familiarize yourself with some of the numbers, try looking up the financials of three companies you own or are interested in.

(Balance Sheet) Which of the companies has the greatest long term debt load? Do any of the companies have greater current liabilities than current assets? Compare the current share price to the shareholder’s equity (book value): is the share price much greater or less than the book value?

(Earnings Statement) What were the revenues of the most recent year (or quarter) and does the number represent an increase or decrease from the previous period? How much money per share did the company earn (or lose) in the most recent period?

(Statement of Changes in Financial Position) Has company debt been increasing or decreasing? What was the greatest expense the company incurred according to the statement?

Decision Making

Understand that financial statements can provide investors with a partial fundamental snapshot of a company. They only represent one piece of the puzzle. Remember that, while financial statements can help investors compare several companies, comparison is limited only to the numbers provided.

In other words, you can see that one company made money while the other lost money, but you don’t know which has the better technical outlook (based on analysis of the trading chart), which is a potential takeover target, which will have the best future earnings, etc…

As well, the impact of financial statements tends to be long-term as it relates to share prices. Four quarterly reports showing increasing earnings may push the stock into an upward trend as the market begins to recognize the fundamental improvements of the underlying company, but one quarter of increasing earnings may or may not have a significant impact on shares.

Therefore, most investors use financial statements as part of a greater overall decision making process. Certainly, though, an understanding of and familiarization with the data can benefit any investor who takes the time to make educated trading decisions.

Important Points

Many growth companies don’t need nor are expected to have positive earnings. Instead, they generally accumulate debt as they focus on research and development of new technologies, aggressively move into new markets, fight for market share with competitors, etc… Other companies with minimal growth prospects on the other hand, have more importance placed on actual earnings, lowering operational costs, etc…

Be sure to understand what numbers are important and unimportant to a specific company based on their situation and the position they are in. This can be done easily by going to wsrn.com and doing an industry comparison on the company in question. Do companies in the same industry seem to have positive earnings, or is the focus on growth, research, etc… Are they a larger or smaller company than the industry average, and are they growing faster than the others?

Read the fine print to make sure the numbers you are reading have been audited, rather than being just company estimates, or unverified results. This generally is not something you need to worry about with most exchange-listed companies, but it is important practice.

Many annual statements will begin with positive news about sales or revenue increases, or other positive comments, but further reading reveals that the company actually lost more money, increased debt, or had a poor quarter or year. For most companies their financial statements are part of their promotional material and they need to make the information sound as impressive and positive as possible, even if the overall results were disappointing.

Be wary of one-time earnings or loses. For example, a company may win a huge lawsuit settlement and the influx of money gives them positive earnings for the quarter. However, how would they have done when the one-time extraordinary is ignored? Learn more at http://www.pennystockinsider.com.

Tinggalkan Balasan