Introduction: Why Financial Control Is a Leadership Skill

As a CEO, your decisions shape not only the future of your organization but also the trajectory of your personal life. Financial control is not merely about numbers on a balance sheet; it is about clarity, discipline, foresight, and responsibility. Just as you would never run a company without a strategy, clear reporting, and risk management, you should never approach your personal or organizational finances without a structured plan.

Taking control of your finances is a leadership skill. It reflects your ability to think long term, manage uncertainty, allocate resources efficiently, and remain resilient during economic turbulence. In an increasingly volatile global economy, financial literacy and discipline are no longer optional—they are essential.

This article is written from a CEO’s perspective, focusing on strategic thinking, sustainable growth, and long-term value creation. Whether you are leading a startup, scaling a growing enterprise, or managing established wealth, the principles outlined here will help you take control of your finances with confidence and intention.

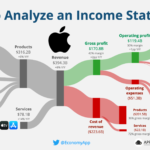

1. Understanding Your Financial Reality

The first step toward financial control is brutal honesty. Many individuals, including highly successful executives, avoid confronting the full picture of their finances. They may focus on income while ignoring expenses, or celebrate growth while overlooking inefficiencies and hidden risks.

As a CEO, you are trained to rely on accurate data. Apply the same discipline to your finances. Begin with a comprehensive financial snapshot:

- Total income from all sources

- Fixed and variable expenses

- Assets (cash, investments, property, equity)

- Liabilities (loans, credit, obligations)

- Net worth

This process is not about judgment; it is about awareness. You cannot improve what you do not measure. Once you understand your current position, you can make informed decisions aligned with your goals.

Financial clarity also reduces stress. Uncertainty creates anxiety, while transparency empowers action. Knowing exactly where you stand allows you to move forward with purpose.

2. Defining Clear Financial Goals

In business, vision drives execution. The same is true for personal finance. Without clear goals, financial decisions become reactive rather than strategic.

Your financial goals should be specific, measurable, and time-bound. They typically fall into three categories:

- Short-term goals (0–2 years): building an emergency fund, reducing high-interest debt, stabilizing cash flow.

- Medium-term goals (3–7 years): purchasing property, expanding investments, funding education, scaling a business.

- Long-term goals (10+ years): financial independence, retirement planning, legacy building, philanthropy.

As a CEO, your goals should align with your broader life vision. Ask yourself:

- What does financial freedom mean to me?

- How much risk am I willing to accept?

- What kind of lifestyle do I want now and in the future?

- What legacy do I want to leave behind?

Clear goals transform money from a source of pressure into a tool for intentional living.

3. Mastering Cash Flow Management

Cash flow is the lifeblood of any organization—and of personal finance. Many financially successful individuals fail not because of low income, but because of poor cash flow management.

To take control, you must ensure that your cash inflows consistently exceed your outflows. This requires discipline, planning, and regular review.

Key principles include:

- Pay yourself first: Prioritize savings and investments before discretionary spending.

- Control lifestyle inflation: Increased income should not automatically lead to increased expenses.

- Track spending patterns: Identify leaks and inefficiencies.

- Maintain liquidity: Ensure access to cash for opportunities and emergencies.

As a CEO, think of your personal cash flow like a company’s operating budget. Every expense should have a purpose, and every allocation should support your strategic objectives.

4. Building a Strong Financial Foundation

Before pursuing aggressive growth or high-return investments, you must establish a stable financial foundation. This foundation provides resilience during uncertainty and flexibility during opportunity.

Emergency Fund

An emergency fund is non-negotiable. It protects you from unexpected events such as economic downturns, health issues, or sudden business challenges. Ideally, this fund should cover 6–12 months of living expenses and be held in liquid, low-risk instruments.

Debt Management

Not all debt is bad, but unmanaged debt is dangerous. High-interest consumer debt erodes wealth and limits strategic options. As a CEO, you should approach debt strategically:

- Eliminate high-interest debt as a priority

- Use leverage only when it creates long-term value

- Understand the true cost of borrowing

Debt should serve your strategy, not control it.

5. Strategic Investing for Long-Term Growth

Investing is not speculation; it is the disciplined allocation of capital to generate future value. A CEO approaches investing with the same mindset used in corporate strategy: diversification, risk management, and long-term perspective.

Key investment principles include:

- Diversification: Avoid overexposure to a single asset, sector, or geography.

- Time horizon: Align investments with long-term goals.

- Risk-adjusted returns: Focus on sustainable growth, not short-term gains.

- Consistency: Regular investing outperforms emotional timing.

Your investment portfolio may include equities, bonds, real estate, private equity, or alternative assets. The exact mix should reflect your risk tolerance, expertise, and financial objectives.

Remember, the goal is not to beat the market—it is to build lasting wealth.

6. The Role of Financial Systems and Automation

Successful CEOs rely on systems, not willpower. Financial automation reduces friction, minimizes errors, and ensures consistency.

Consider automating:

- Monthly savings and investments

- Debt repayments

- Bill payments

- Expense tracking

Automation turns good intentions into default behavior. It also frees mental bandwidth, allowing you to focus on higher-value decisions.

In finance, discipline beats motivation every time.

7. Risk Management and Protection

Taking control of your finances also means protecting what you have built. Risk management is not pessimism; it is responsibility.

Essential protection strategies include:

- Adequate insurance coverage (health, life, property)

- Legal structures for asset protection

- Estate planning and succession planning

- Business continuity planning

As a CEO, you understand that unmanaged risk can destroy years of progress. Personal finance is no different. Protection ensures that one unexpected event does not derail your entire financial plan.

8. Financial Leadership Within the Organization

Your personal approach to finance influences your leadership style. CEOs who demonstrate financial discipline set the tone for their organizations.

When leaders:

- Make data-driven decisions

- Respect capital allocation

- Balance growth with sustainability

- Plan for the long term

They build trust among investors, employees, and partners. Financial leadership is cultural, not just technical.

By taking control of your own finances, you strengthen your credibility as a leader.

9. Continuous Learning and Advisory Support

No CEO succeeds alone. Financial environments evolve, regulations change, and new opportunities emerge. Continuous learning is essential.

Consider working with:

- Financial advisors

- Tax professionals

- Legal experts

- Investment specialists

The goal is not to outsource responsibility, but to enhance decision quality. Surround yourself with experts who challenge assumptions and provide perspective.

A strong advisory network is a strategic asset.

10. Building a Legacy Beyond Wealth

True financial success is not measured solely by net worth. It is measured by impact, freedom, and legacy.

As a CEO, you have the opportunity to:

- Support causes you believe in

- Create opportunities for others

- Build generational wealth responsibly

- Leave values, not just assets

Taking control of your finances enables you to contribute meaningfully to society while maintaining independence and integrity.

Conclusion: Financial Control as a Lifelong Strategy

Taking control of your finances is not a one-time event; it is a lifelong strategy. It requires discipline, reflection, and adaptation. Like leadership itself, financial mastery evolves with experience and context.

As a CEO, you are uniquely positioned to apply strategic thinking to your financial life. By understanding your financial reality, defining clear goals, managing cash flow, investing wisely, and protecting your assets, you create a foundation for sustainable success.

Ultimately, financial control is about freedom—the freedom to make decisions aligned with your values, to navigate uncertainty with confidence, and to build a future on your own terms.

The most effective leaders do not leave their finances to chance. They lead them with intention.

Word Count:

707

Summary:

Discusses how to take control of your money, so that you can find funds to invest for the future.

Keywords:

budget,budgeting,financial security,invest,investing

Article Body:

To find money to invest for your future, you need to make sure that your outgoing expenses are less than the income that you are receiving. You need to develop an excess that you can have free to invest.

Now before you start to think�.�well I don�t have any excess left�if I was earning more money�.then I would have some free�. Let me dispel this myth�and tell you that it is a known and excepted fact that the amount of money that people earn has little if any bearing on whether or not they have an excess left to invest. The only way to create an excess it to spend less than you earn, instead of spending all that you earn.

Even doctors and lawyers, who earn well over $100,000.00 per year, often end up at retirement with little more Net Worth than factory or office workers.

Net Worth is calculated by deducting the value of all the liabilities or loans you have from the income-producing assets owned to give you the net value of your income-producing assets.

Why aren�t high-income earners retiring wealthy? Why don�t they end up with a greater Net Worth than someone on a low income? It is quite simple. Human nature seems to dictate that whatever anyone earns�.they spend�.some even spend more than they earn and charge it on their credit card.

The higher your income grows�the more you spend and the only way to get out of this cycle is to realise that it is happening, and make a concerted effort to reverse this habit�.and to begin reducing your expenditures so that you can free up money to invest.

The best way to do this, is to try the 10/90 plan. This plan simply means that as soon as you receive your pay�.you put aside 10% of it for investment�.and then use the other 90% to live off of. Put aside the 10%, and then pay all the bills and do the grocery shopping�.and then after that whatever is left over you can spend.

Most people do it the wrong way around�they pay the bills, do the shopping and spend what is left over, never leaving any left to save or invest. By taking the investment money out first you will alleviate the temptation to spend it.

The road to wealth is not determined by how much you earn, but by how you utilise the income you have and how much you save and invest.

You need to take control of your finances. One of the best ways to start having more control over your money is to find out where it has all been going, and then amend your spending habits to allow you to live within the 10/90 plan.

If you write down a list of your monthly net income, then in another column write down a list of the essential items that you have to spend money on. You should be able to work out an average for telephone, gas, electricity, insurances and rates, from your previous bills. Work out an average of how much is spent on grocery shopping and petrol. If there are any other necessary utilities include them as well. Then deduct the second column from the first � and this will give you the maximum potential savings for each month.

It can be quite startling how high this figure can be and make you wonder where all the extra money went.

Another good learning experience is to simply write down for a fortnight every dollar spent and write next to it what it was for. You will soon find that there are a lot of unnecessary expenses, often caused by impulse buying, where you have spent money on items that you neither needed or really wanted, and could easily have gone without.

When you can begin to recognise these areas, and start to consider whether or not you are spending your money wisely, before you hand it over, then you will be beginning to take control over your money and are well on the way to embarking on your investment journey, which will enable you to have a financially secure future for you and your children.

Tinggalkan Balasan