Introduction: Why Monitoring Matters at the Executive Level

For a CEO, monitoring is not an administrative task—it is a strategic discipline. In business, constant monitoring of performance indicators, cash flow, market trends, and operational efficiency is what separates resilient organizations from those that fail under pressure. The same principle applies to personal and executive-level finances. Monitoring your finances is not about control for control’s sake; it is about insight, learning, and informed decision-making.

Monitoring your finances reveals priceless lessons because money reflects behavior, priorities, discipline, and leadership mindset. Every transaction tells a story. Every trend highlights a strength or exposes a weakness. Over time, these insights shape not only financial outcomes but also personal growth and executive maturity.

This article explores how consistent financial monitoring offers invaluable lessons for CEOs and senior leaders. It examines financial awareness as a leadership competency, a strategic advantage, and a foundation for long-term success. From cash flow discipline to ethical decision-making, monitoring finances teaches lessons that extend far beyond balance sheets.

1. Financial Monitoring as a Leadership Habit

Great leaders are defined by their habits. Monitoring finances is one of the most underrated yet powerful habits a CEO can cultivate. While delegation is essential, abdication is dangerous. CEOs who distance themselves entirely from financial data lose touch with reality.

Monitoring does not mean micromanaging. It means maintaining visibility. It means knowing where resources are allocated, understanding trends, and recognizing early warning signs. When a CEO regularly reviews financial data, they develop intuition grounded in facts rather than assumptions.

This habit reinforces accountability. Leaders who monitor their own finances tend to be more disciplined, intentional, and consistent. They understand the cause-and-effect relationship between decisions and outcomes, both personally and professionally.

2. Awareness Precedes Control

One of the most important lessons revealed by monitoring finances is simple yet profound: awareness precedes control. Many executives earn substantial income yet feel financial stress because they lack clarity. Without monitoring, spending becomes reactive, and wealth becomes fragile.

When you monitor your finances, patterns emerge. You see where money flows effortlessly and where it leaks silently. You recognize which expenses align with your values and which are driven by impulse or ego.

This awareness empowers control. You cannot optimize what you do not observe. CEOs who monitor finances gain the ability to redirect resources toward what truly matters—growth, security, impact, and freedom.

3. Cash Flow Teaches Operational Discipline

Cash flow is not just a financial metric; it is a behavioral indicator. Monitoring cash flow teaches CEOs the importance of timing, discipline, and consistency.

Many leaders focus on income and net worth while overlooking cash flow dynamics. However, liquidity determines flexibility. Monitoring cash inflows and outflows reveals whether your lifestyle and commitments are sustainable.

This lesson mirrors corporate leadership. Profitable companies fail when cash flow collapses. Likewise, high-earning individuals face crises when expenses outpace liquidity. Monitoring cash flow reinforces the executive mindset that survival and growth depend on disciplined execution, not just high performance.

4. Spending Patterns Reflect Values

One of the most revealing lessons from financial monitoring is the alignment—or misalignment—between stated values and actual behavior. Your bank statements are more honest than your intentions.

CEOs often speak about long-term vision, legacy, and impact. Monitoring expenses shows whether daily decisions support those ideals. Excessive discretionary spending, unmanaged subscriptions, or impulsive purchases highlight gaps between aspiration and action.

This lesson is invaluable. It encourages self-reflection and course correction. Leaders who align spending with values experience greater satisfaction, reduced stress, and stronger financial outcomes.

5. Small Decisions Create Long-Term Outcomes

Monitoring finances teaches the compounding effect of small decisions. Minor expenses, overlooked fees, or inconsistent saving habits seem insignificant in isolation but become powerful over time.

CEOs understand compounding in business growth, talent development, and brand equity. Financial monitoring reinforces this principle personally. It shows how consistent investing, disciplined saving, and controlled spending quietly build resilience and wealth.

This lesson cultivates patience. It shifts focus from short-term gratification to long-term value creation—a hallmark of effective leadership.

6. Financial Monitoring Sharpens Strategic Thinking

Regular financial review enhances strategic thinking. By analyzing trends, comparing periods, and identifying anomalies, CEOs strengthen their analytical skills.

Monitoring teaches leaders to ask better questions:

- Why did expenses increase this quarter?

- What decisions led to this outcome?

- Which investments are underperforming?

- Where can capital be reallocated more effectively?

These questions translate directly into organizational leadership. CEOs who practice strategic financial monitoring personally are better equipped to guide their companies through complexity and uncertainty.

7. Risk Becomes Visible Before It Becomes Dangerous

One priceless lesson of financial monitoring is early risk detection. Risks rarely appear suddenly; they accumulate quietly.

Monitoring reveals warning signs such as:

- Increasing reliance on debt

- Declining savings rates

- Overconcentration in a single asset

- Lifestyle inflation disconnected from income stability

By identifying risks early, CEOs retain options. They can adjust strategies, reduce exposure, and strengthen safeguards. This proactive approach mirrors effective enterprise risk management.

8. Discipline Outperforms Brilliance

Another powerful lesson is that discipline consistently outperforms brilliance. Financial success is rarely the result of extraordinary intelligence alone. It is the result of consistent, disciplined behavior.

Monitoring reinforces discipline by creating feedback loops. Regular review encourages accountability and reinforces good habits. CEOs learn that sustainable success depends more on execution than on bold predictions or speculative moves.

This lesson is humbling and empowering. It reminds leaders that excellence is built through repetition, not occasional bursts of effort.

9. Emotional Intelligence and Money

Money triggers emotions—fear, pride, anxiety, confidence. Monitoring finances helps CEOs develop emotional intelligence by confronting these emotions with data.

Instead of avoiding uncomfortable truths, leaders learn to engage with them rationally. Monitoring reduces emotional decision-making by replacing assumptions with evidence.

This lesson strengthens leadership maturity. CEOs who manage financial emotions effectively are better decision-makers, negotiators, and crisis leaders.

10. Financial Monitoring Reinforces Accountability

Accountability is a core leadership principle. Monitoring finances reinforces personal accountability.

When CEOs review their finances regularly, they take ownership of outcomes. They stop blaming markets, advisors, or circumstances and focus on controllable actions.

This mindset carries into organizational culture. Leaders who model accountability inspire teams to take responsibility, measure performance, and pursue continuous improvement.

11. Data Over Assumptions

Monitoring teaches CEOs to prioritize data over assumptions. Many financial mistakes stem from outdated beliefs or unchecked optimism.

Consistent monitoring replaces narratives with numbers. It reveals whether strategies are working and whether adjustments are needed.

This lesson aligns perfectly with modern leadership, where data-driven decision-making is essential for competitiveness and credibility.

12. Long-Term Thinking Becomes Natural

As monitoring becomes habitual, long-term thinking becomes instinctive. CEOs begin to view decisions through a multi-year lens.

Monitoring highlights trends rather than isolated events. It encourages patience, resilience, and adaptability.

This lesson supports sustainable leadership. Leaders who think long term build organizations—and lives—that endure.

13. Financial Transparency Builds Trust

Monitoring finances promotes transparency. Transparency builds trust—with advisors, partners, family, and stakeholders.

CEOs who maintain clear financial records and open communication reduce misunderstandings and conflicts. Transparency also enhances governance and ethical standards.

This lesson reinforces the idea that trust is built through clarity, not secrecy.

14. Monitoring Enables Better Advisory Relationships

Effective advisors rely on accurate data. Monitoring finances improves the quality of advisory relationships.

When CEOs bring clarity to discussions, advisors can offer more strategic guidance. Monitoring transforms advisors from reactive problem-solvers into proactive partners.

This lesson emphasizes collaboration and continuous improvement.

15. Financial Monitoring as a Tool for Freedom

Perhaps the most priceless lesson is that monitoring finances creates freedom. Not restriction, but freedom.

Clarity enables choice. Discipline enables flexibility. Awareness enables confidence.

CEOs who monitor their finances gain the freedom to pursue opportunities, weather downturns, and align decisions with values.

Conclusion: Priceless Lessons Beyond Numbers

Monitoring your finances reveals lessons that extend far beyond money. It teaches discipline, awareness, accountability, emotional intelligence, and strategic thinking. These qualities define exceptional CEOs.

Financial monitoring is not a task to be delegated or avoided. It is a leadership practice—a mirror reflecting priorities and progress.

For CEOs committed to sustainable success, monitoring finances is not optional. It is the foundation upon which resilience, growth, and legacy are built.

Ultimately, the greatest value of financial monitorin

Word Count:

808

Summary:

A most important element for building wealth is to measure it. The people I know that have continually increased their net worth track it in order to direct it and stay motivated to reach ever higher financial goals. Seeing the quantifiable results of your spending and investing decisions is the first step to take control of them. Contrarily, the people I know in the worst financial shape have no idea where there money is spent and are too afraid to know what their net worth …

Keywords:

budgeting,investing,credit cards,personal finance

Article Body:

A most important element for building wealth is to measure it. The people I know that have continually increased their net worth track it in order to direct it and stay motivated to reach ever higher financial goals. Seeing the quantifiable results of your spending and investing decisions is the first step to take control of them. Contrarily, the people I know in the worst financial shape have no idea where there money is spent and are too afraid to know what their net worth might be because it won�t be pretty. Which extreme more closely matches your attitude? As Dr. Deming says, �You can�t manage what you don�t measure.� Think of it: if you were seriously wealthy, you�d spend some time every week managing some aspect of money. Well, if you want to improve your financial condition, a beginner version of a money management and tracking method is required. In addition, the more money you build up, the more financial assets and obligations there are to monitor. If you don�t have your financial tracking in place before you acquire them, I�d bet that you won�t own them for long.

If you don�t see and feel the gains and losses of your financial decisions � you are playing the complicated money-game of life without any scorecard. This is how so many people with decent paying jobs and insurance still get into financial trouble. You need to have navigation reference points to know if you are steering toward building wealth or destroying wealth. It is by monitoring your net worth that you�ll start to uncover the financial impact and consequences of your decisions.

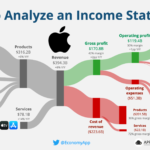

The starting point for financial measuring is a simple statement of net worth (or balance sheet). If you have never heard this term, it is a list of the current market price of everything that you own and what you owe to others. The difference between these two numbers is called your net worth, and this is the number that you want to measure and increase every single month.

As with a business, once you start measuring the financial consequences of your behavior you can begin making your own personal spending rules. For example, if most of your monthly income is spent at restaurants, try making a rule that you only go out twice a week. If you�re spending too much money on gasoline you need to find several ways to reduce it. Simple insights and subsequent rules like these will help increase your net worth, which will lead to bigger insights and develop into bigger gains.

If you find that you have a lot of debt that is decreasing your net worth, or possibly a negative net worth, then what rules about debt are you going to create for yourself? After you get some money saved, where are you going to put it? How much time are you willing to spend monitoring it? How much effort are you willing to exert to educate yourself about investing? These questions will aid in building your investing rules. Eventually you�ll have rules for spending, saving, employing debt, and investing that will shape your personal plan for you to start moving your net worth in a sharply positive direction. Think about adding a rule to read a new financial book each year. Your financial statements and financial rules can be as simple or sophisticated as you want to make them. If you keep making even baby steps forward, it may become no big deal to have specific rules for retirement planning, tax implications, entity structuring, evaluating investment real estate, checklists for buying mining companies, or selling a company you�ve built.

When you have calculated your first statement of net worth, you start having the ability to plan for purchases and payments. As a simple example, if your auto insurance bill arrives once a year, you can calculate how much money that you need to set aside each month to easily pay it when it arrives. Or if you are getting a new car, you�ll be a lot happier planning for the initial costs before you get squeezed at the end of the month and end up paying a few bills late.

After you get comfortable with a net worth statement, you can move on to an income & expense statement. Then move on to making projections for all of your statements. And creating scenarios such as: How much is a reasonable goal for retirement income for you? How much net worth will you need by when? How are you going to increase your income, increase your savings, increase your investment returns? The answers will be built upon the financial habits, tools and education that you�ll develop, but it can all start with your first net worth statement.

Tinggalkan Balasan